Latest Hurricane Updates

Stay ahead of the storm with the National Hurricane Center's latest news. Tracking the latest Hurricane news, alerting you to all the latest updates daily.

Hurricane Laura Upgraded to Likely Intensify

This morning Tropical Storm Laura was upgraded to Hurricane Laura with maximum sustained winds of 75 mph (121 Km/h). The storm is currently located 550 miles southeast of Galveston, TX and is...

National Hurricane Center Tracking 3 Potential Hurricanes

UPDATED August 19 10:37 A.M.: Two potential storms are being tracked in the 5 Day Outlook from the National Hurricane Center, Miami, Florida as of August 18th. Now a third area of disturbance is...

Hurricane Genevieve

Updated 10:29 Central Time August 19, 2020. Pacific Storm Hurricane Genevieve Category 3 Storm Hurricane Genevieve has maximum sustained winds at 130 mph ( Km/h) and is expected to affect the...

Tropical Storm Bertha

Tropical Storm Bertha – May 27-28, 2020 Tropical Storm Bertha was our second named storm of the 2020 Atlantic season and affected a bit more area than Tropical Storm Arthur. TS Bertha winds...

Tropical Storm Arthur

Our first Atlantic tropical storm was another early or “off-season” tropical storm, achieving Tropical Storm status on May 17th, continuing a possibly disturbing trend. The depression...

Saffir-Simpson Scale

What Do Those Dots and Colors Mean? When you see a forecast map with blue triangles and various colored circles, you have to wonder what each one is. Here is the image from the NOAA (National...

Tropical Storm Cristobal

June 2 - 8, 2020 Tropical Storm Cristobal became the earliest third named Atlantic storm on record on June 2, continuing the pattern of earlier and more frequent storms we have been seeing...

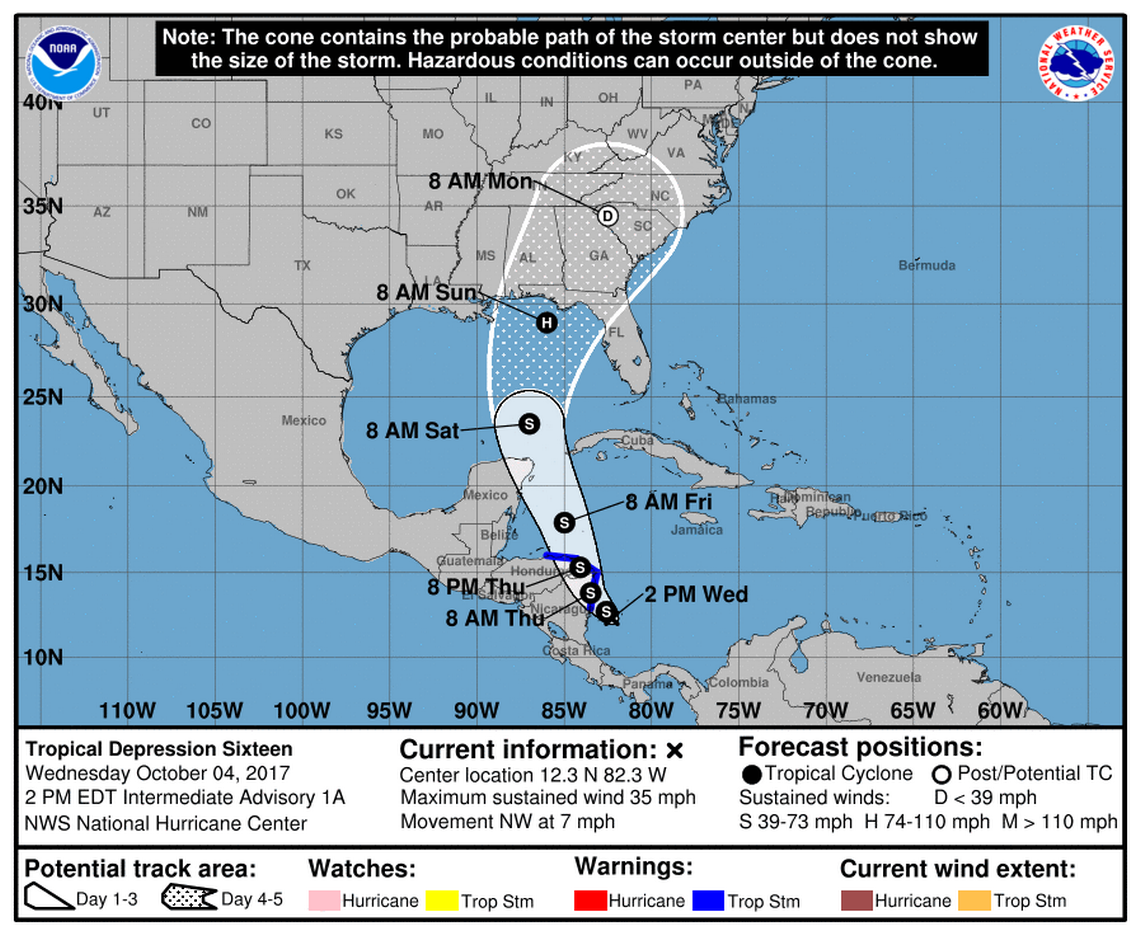

Season’s 14th Named Storm Forms

Tropical Storm Nate A collection of thunderstorms in the Caribbean forms into Tropical Storm Nate Wednesday morning at 11 am . According to The National Hurricane Center, the storm is...